(Information disclosed on May 12, 2023)

Initiatives Based on TCFD Recommendations

TV Asahi Group (the “Group”) aims to contribute to a sustainable society while achieving Group growth and has announced the “Five Key Issues for the Future” in May 2022 where one of the key issues is “Contributing to the future of earth.” As a media outlet, the Group strives not only to report disaster-related information to save human lives, but also provide information that furthers the protection of the earth’s rich environment.

Moreover, as a corporate citizen, in order to take action towards solving climate change-related issues, the Group has endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)* and discloses below the analysis conducted in line with the TCFD framework.

*The TCFD was established by the Financial Stability Board (FSB) to develop recommendations on the types of climate-related information that companies should disclose to support the assessment conducted by financial institutions. The TCFD recommends that companies disclose information on climate change-related risks and opportunities in the areas of governance, strategy, risk management, and metrics and targets.

Governance

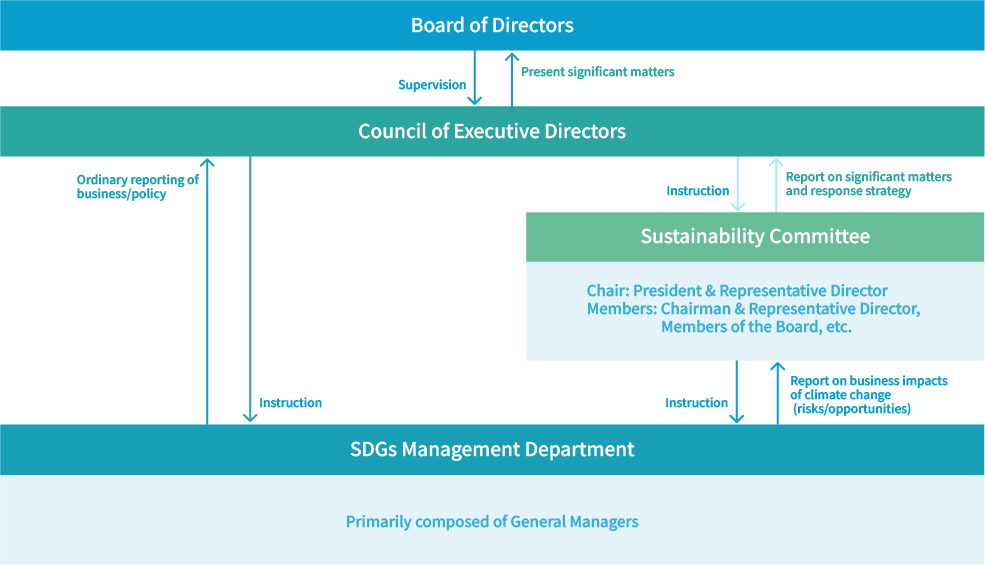

Important matters relating to climate change are deliberated on and determined by the Board of Directors. Two specific bodies outlined below aim to continuously focus on identifying/assessing and promptly reflecting in business strategies the risks and opportunities that may significantly impact the sustainable growth and continuity of the Group.

- Sustainability Committee

-

The President and Representative Director serves as chair of the Sustainability Committee, which is responsible for monitoring and managing risks and opportunities related to sustainability, including climate change.

- SDGs Management Department

-

The SDGs Management Department is composed primarily of general managers of TV Asahi Holdings Corporation and TV Asahi. It is responsible for assessing and examining climate change-related risks and opportunities.

Matters deliberated by the SDGs Management Department are reported to the Sustainability Committee once a year and then reported to the Council of Executive Directors. Matters deemed important by the Council of Executive Directors are presented to the Board of Directors.

Strategy

Utilizing the scenario analysis methodology recommended by the TCFD, the Group has identified and assessed the future risks and opportunities for 2030 from both qualitative and quantitative perspectives. The Group has also considered and implemented measures relating to risks and opportunities deemed to have significant impact. The scenario analysis is based on the following two scenarios:

1. A “Below 2°C” scenario where the impact of transitioning to a low-carbon society is greater than the present.

2. A “4°C” scenario where the physical impacts of climate change are substantial.

- 1. “Below 2°C” Scenario Analysis

“Below 2°C” scenario

A scenario where the rise in temperature from the Industrial Revolution to the year 2100 is held within 2°C. This scenario assumes global warming is curbed by reducing the increase in atmospheric greenhouse gas levels as a result of government decarbonization policies and regulations that are more stringent than those currently in place and changes in the market.

- Specific scenarios utilized:

RCP2.6 (Source: Intergovernmental Panel on Climate Change (IPCC) “Fifth Assessment Report” (AR5))Net Zero Emissions by 2050 Scenario (Source: International Energy Agency (IEA) “Net Zero by 2050”)

Sustainable Development Scenario (Source: International Energy Agency (IEA) “World Energy Outlook 2019” (WEO 2019))

-

The Group’s operating costs would increase as a result of taxation of CO2 emissions from business activities due to the introduction of carbon taxes aimed at reducing greenhouse gas emissions, and a steep rise in electricity prices due to the growing proportion of renewable energy used. If the Group’s decarbonization efforts are deemed insufficient as concern for climate change grows, a decrease in advertisement placements and decline in viewership is expected. Moreover, companies in industries that are vulnerable to transitional impacts to decarbonization are expected to be equally affected by the aforementioned factors.

-

One way the Group is managing the impending carbon taxes and steep rise in electricity prices is reducing power consumption, such as switching to LED lighting. A 50% reduction target from FY21/3 to FY31/3 in the lighting power consumption of studio facilities at the TV Asahi Headquarters Building has been established. The Group is also targeting a 100% renewable energy ratio at the Headquarters Building by FY31/3 through initiatives such as switching to green power.

On the news reporting front, TV Asahi and BS Asahi became signatories to the SDG Media Compact in July 2020 and February 2020, respectively, and have been making efforts to delivering information that contributes to solving SDG-related issues including climatic and environmental matters. In 2022, both companies participated in the campaign “Promise of 1.5°C,” which was carried out by the United Nations and Japanese companies that are signatories to the SDG Media Compact, and broadcast information on a wide range of climate change issues. The campaign will be held again in 2023 and the Group looks forward to expanding its efforts that contribute to the sustainability of society.

In addition to collaboration with external organizations, the Group also implements its own initiatives, such as regularly slotting “SDGs Week” as part of its “The Future Starts Here Project.” Recently, TV Asahi covered the 64th Japanese Antarctic Research Expedition and reported on the impact of global warming in Antarctica and on the expedition’s research. The Group will continue to work on furthering public discourse through its content and by drawing on the characteristics of its media outlets.

Moreover, the Group will strengthen coordination with companies in industries that are vulnerable to the impacts of decarbonization by enhancing collaboration through monitoring market trends, creating more opportunities for dialogue, and other such efforts.

- 2. “4°C” Scenario Analysis

“4°C” scenario

A scenario where the rise in average temperature from the Industrial Revolution to the year 2100 is approximately 4°C. It does not assume a transition to decarbonization and is predicated upon current government policies remaining in place, leading to the industries continuing to depend on fossil fuels.

- Specific scenarios utilized:

RCP8.5 (Source: Intergovernmental Panel on Climate Change (IPCC) “Fifth Assessment Report” (AR5))Stated Policies Scenario (Source: International Energy Agency (IEA) “World Energy Outlook 2021” (WEO 2021))

-

Under this scenario, domestically, it is expected that extreme weather disasters, particularly storm and flood damages, will be more frequent and severe. Such calamities will impair the Group’s business facilities, news reporting activities, event functions, etc. and shall impact the Group financially. Moreover, revenue will also be impacted if business partners that are susceptible to weather disasters reduce their advertising placements after incurring disaster-related losses or opt to refrain from advertising in the aftermath of disasters.

-

As response to such risks, the Group is working to create and secure a news reporting system to promptly deliver accurate information on and during extreme weather disasters. Specifically, as a reliable media outlet, the Group shall provide timely disaster and meteorological information, archive disaster information, work on improving the Group’s Business Continuity Plan and proactively make Group facilities available for community bases in the event of disasters.

- List of quantitative risks and opportunities

-

<List of quantitative risks and opportunities>

Items Timeline Impact Assessment Countermeasures Below 2°C scenario 4°C scenario Transition risks Gov. policies, regulations Medium to long-term Increase in operating costs due to introduction of carbon tax Major Minor Reduce CO2 emissions by switching to LED lighting and renewable energy Market Medium to long-term Increase in electricity costs with increased percentage of renewable energy utilized Medium Minor Reduce electricity consumption Physical risks Acute Short to long-term Increase in costs due to Group business sites affected by disasters Minor Minor Enhance Business Continuity Plan such as installing water stoppers at entrances to Headquarters Building Chronic Short to long-term Increase in air conditioning costs due to rise in average temperatures Minor Minor Reduce electricity consumption and increase use of renewable energy <List of qualitative risks and opportunities>Items Timeline Impact Assessment Countermeasures Below 2°C scenario 4°C scenario Transition risks Market Medium to long-term Decrease in viewer ratings and advertising opportunities due to ineffectiveness in capturing viewer needs relating to climatic changes and reflecting such subject matters in content creation ✔ X Proactive distribution of information on climate change

Strengthen collaboration through monitoring and dialogue on market trends regarding transition to decarbonizationReputation Short to long-term Reputational damage among customers and viewers, and decreased viewer ratings and opportunities for advertising, due to Group's response to climate change ✔ X Enhance climate change response including reduction of CO2 emissions Physical risks Acute Short to long-term Reduction in advertising opportunities due to disaster impact on client companies and/or increase in catastrophic disasters ✔ ✔ Strengthen collaboration through monitoring and information-gathering on customer trends relating to impact of extreme weather conditions

Enhance information distribution process through archiving disaster-related information, etc.Items Timeline Impact and response Assessment Measures Below 2°C scenario 4°C scenario Transition opportunities Market Medium to long-term Increase in advertising opportunities due to the increased decarbonization-related activities and technological advancements ✔ X Strengthen collaboration through monitoring and information-gathering on customer trends relating to transition to decarbonization Medium to long-term Increase in demand for climate change-related content due to increased educational needs of related issues ✔ X Physical opportunities Resilience Short to long-term Increase in earnings due to increased demand for programs and information on weather disasters ✔ ✔ Diversify information distribution process such as archiving disaster-related information, etc. Definition of Timeline

Short-term: 0 to 3 years

Medium-term: 0 to 10 years (to around 2030)

Long-term: 10 years or moreDefinition of “Major”, “Medium”, and “Minor” in the quantitative chart

Major: Impact amounting to 100 million yen or more

Medium: Impact between 50 million and 100 million yen

Minor: Impact less than 50 million yenDefinition of “✔” and “X” in the qualitative charts

✔: Impact expected

X: Almost no impact expected

Risk Management

The Group’s climate change-related risk management is conducted by the Board of Directors, Council of Executive Directors, Sustainability Committee, and the SDGs Management Department.

The SDGs Management Department receives regular reports from relevant divisions and departments on the following matters and monitors developments.

1. Reassessment of climate change-related risks and progress management of countermeasures

2. The necessity of expenditure on countermeasures and significant impacts on revenue

Findings are also shared with relevant business units within the company, and deliberations are made on how currently recognized sustainability-related risks are changing, as well as on the need for implementation of additional countermeasures. Matters that need to be reported to the Sustainability Committee are then presented. Upon receiving reports, the Sustainability Committee may seek input from external experts to help determine the need for countermeasures. If the risks are deemed to be significant, the Sustainability Committee will report such matters and response strategies to the Council of Executive Directors. The Council of Executive Directors will incorporate the risk analysis into other sustainability-related and other Group-wide risks and conduct reassessments. Risks that are deemed to be significant will be reported to the Board of Directors for deliberation and the Board of Directors will make final decisions on countermeasures and response timelines.

Key sustainability-related issues and the identification process

Metrics and Targets

The Group uses greenhouse gas (GHG) emissions, electricity consumption, and the percentage of renewable energy used, as indicators to assess and monitor climate change impacts.

The Group is currently discussing its GHG emission reduction target and will disclose the target once established. As for recent track records, GHG emissions for FY22/3 totaled 23,501 tons, with Scope 1 emissions (direct emissions from business activities) accounting for 168 tons and Scope 2 emissions (indirect emissions from electricity consumption) accounting for 23,333 tons. Efforts to reduce CO2 emissions include utilizing co-generation system services, rooftop greening and taking advantage of daylight through the use of glass exterior walls.

The Group is targeting a 50% reduction by FY31/3 in lighting electricity consumption in its Headquarters Building studio facilities in comparison to FY21/3 levels. Measures such as switching to LED studio lighting are being taken and approximately 450 lights in Studio 3 and Studio 4 where changed to LEDs in January 2021, followed by 115 lights in Studio 5 in January 2023.

Regarding the transition to renewable electricity consumption, the Group has a target to achieve 100% at its Headquarters Building by FY31/3. To achieve the target, the Group is proactively switching to renewable energy, such as switching to green electricity generated from 100% renewable sources.

| FY22/3 results | |

|---|---|

| Scope 1 | 167.8 (tCO2) |

| Scope 2 | 23,333.3 (tCO2) |

Scope of calculation:

TV Asahi Corporation

Asahi Satellite Broadcasting Limited

CS One Ten, Ltd.